A cryptic702 sw 8th st charge on credit statement can send shivers down anyone’s spine. Confusion ensues, followed by a nagging worry: Is it legit? Are you being scammed? Fear not, financially savvy sleuths! This blog post equips you with the tools and knowledge to unravel this mystery and restore peace to your financial world.

702 sw 8th st charge on credit card coming from?

If This is the address shown on your credit card statement then indicates it’s coming from Walmart.

Activity That Might Cause This Charge?

Before we embark on our investigative journey, let’s introduce the cast of suspects:

The Recurring Rascal:

Did you sign up for a free trial or subscription service at 702 SW 8th St. (a virtual address used by Walmart Marketplace sellers) and forget to cancel? Remember, free trials sometimes morph into unwelcome guests on your statement.

The Online Order Ogre:

Did you recently add something to your cart and click “buy” on Walmart.com, only to forget about alternative payment methods like gift cards or store credit? This seemingly Walmart-related charge could be your order finally catching up.

The Charitable Chameleon:

Did you contribute to a worthy cause affiliated with Walmart or an event held at 702 SW 8th St.? A noble deed indeed, but ensure your generosity hasn’t been met with unexpected charges. Double-check your donation history.

The Fraudulent Fiend:

Let’s not shy away from the harsh reality. Hackers can disguise transactions like “Walmart 702 SW 8th St.” to mask their tracks. Keep your eyes peeled, folks, and don’t trust every bargain deal – a good detective is always suspicious.

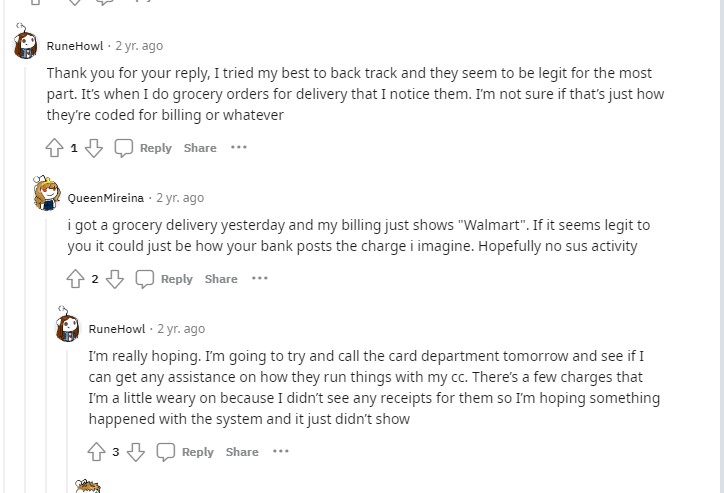

People’s Opinion About 702 sw 8th st charge on credit card

Case Study 1:

We search on Reddit About This Mystery Charge. let’s explore Them:

A possible reason for the charge could be based on the above discussion;

Walmart’s Delivery Billing:

Some users have reported seeing “Walmart” instead of “702 SW 8th St.” for their delivery charges, suggesting it could be how their bank displays the transaction.

Walmart System Glitch:

Occasional inconsistencies in billing descriptions due to system hiccups or processing errors have been mentioned by some users.

Recommendations:

To ensure peace of mind, you can take these steps:

Confirm Order History:

Compare the charge amount on your statement with your Walmart delivery order confirmation. Seeing matching details can confirm it’s a legitimate charge.

Contact Walmart Customer Service:

If you’re still unsure, reach out to Walmart customer service to clarify the charge and confirm its origin. Their customer service can check your order details and explain the billing process.

Monitor Future Statements:

Keep an eye on future statements for similar charges. Consistency over time can further indicate a regular billing practice.

Walmart Statement Regarding This Charge :

Let’s See what Walmart has to say about this charge on your credit card.

After Reading the Statement Here are ways To Contact Walmart Fast:

Here are several ways to contact Walmart regarding a credit card charge you have questions about:

Phone:

Customer Service:

1-800-925-6278 (1-800-WALMART) is the main customer service number. While their automated system might not directly lead you to a representative about credit card charges, you can usually say “credit card” or “billing” to be directed to the appropriate department.

Financial Services Help Center:

You can call 1-877-860-1250 if you have specific questions about a Capital One® Walmart Rewards Mastercard® or Walmart Rewards™ Card charge.

Online:

Walmart Help Center: Visit https://www.walmart.com/help and select “Account & Payments” from the “Help Topic” menu. You can then choose “Credit Card Chargeback Process” or “Unauthorized Charges” for relevant information and potentially initiate a dispute online.

Twitter: You can send a direct message to @WalmartHelp on Twitter. Be sure to provide your contact information and details about the charge you’re inquiring about.

In-Store:

Customer Service Desk:

Visit the customer service desk at your local Walmart and speak to a representative. They can access your order history and may be able to answer your questions about the charge.

Additional Resources:

Dispute a Charge:

If you believe the charge is unauthorized, you can dispute it directly with your bank. Contact your bank’s customer service for assistance.

Report Fraud:

If you suspect fraudulent activity, report it to Walmart and your bank immediately. You can also report it to the Federal Trade Commission (FTC) online at https://consumer.ftc.gov/features/identity-theft or by calling 1-877-ID-THEFT (1-877-438-4338).

Here are some additional tips for contacting Walmart about a credit card charge:

Gather Information:

Before contacting Walmart, gather as much information as possible about the charge, such as the date, amount, merchant name, and any related order numbers.

Be Clear and Concise:

Explain your query clearly and concisely to the representative.

Be Patient:

It may take some time to resolve your issue, so be patient and persistent.

How To Dispute False Walmart charge on the Credit Cards.

Here’s how to dispute a false Walmart charge on your credit card:

1. Gather Evidence:

Credit Card Statement:

Locate the disputed charge on your statement and note the date, amount, merchant name (might say “Walmart” or “702 SW 8th St.”), and transaction reference number.

Supporting Documents:

Gather any relevant documents you have like purchase receipts, emails regarding the order, or communication with Walmart customer service.

2. Confirm with Walmart:

Walmart Help Center:

Visit https://www.walmart.com/help: https://www.walmart.com/help and select “Account & Payments” from the “Help Topic” menu. Choose “Credit Card Chargeback Process” or “Unauthorized Charges” for relevant information.

Customer Service:

If you suspect it’s a billing error, contact Walmart customer service at 1-800-925-6278 (1-800-WALMART) to clarify the charge and confirm its origin. They can check your order details and explain the billing process.

3. Dispute with your Bank:

Phone:

Call your bank’s customer service number directly from the number on your card. Choose the option for disputes or billing inquiries.

Online:

Many banks allow online dispute initiation through their secure online banking platform. Look for options like “dispute transaction” or “report fraud.”

In-Person:

If convenient, visit your bank branch and speak to a representative. They can guide you through the dispute process.

4. Explain the Situation:

Clearly explain to the bank representative that you believe the charge is unauthorized. Describe the charge in detail and provide any evidence you gathered from Walmart or your records.

5. Follow the Dispute Process:

- Your bank will guide you through their specific dispute process, which may involve completing a form, providing additional information, and communicating with Walmart.

- Cooperate with the investigation and respond promptly to any requests from your bank.

6. Monitor Progress:

Keep track of communication with both your bank and Walmart.

Monitor your credit card statement to see if the disputed charge has been removed or adjusted.

If the dispute is resolved in your favor, ask your bank if they can reissue your card with a new number for added security.

Additional Tips:

Monitor Your Credit Report:

Regularly check your credit reports from all three major bureaus for any unauthorized activity. You can obtain free credit reports annually through https://www.annualcreditreport.com/index.action